Diving into the world of Bitcoin price data, this guide provides a deep dive into the Bitcoin Price USD API. Understanding real-time price fluctuations is crucial for investors and traders alike. We’ll explore historical trends, key influencing factors, and practical applications.

From accessing the API to interpreting the data, this resource covers all the essentials for leveraging Bitcoin price information effectively. We’ll also delve into the broader cryptocurrency market context and how Bitcoin’s price interacts with other digital assets.

Bitcoin Price Data Overview

Bitcoin, a pioneering cryptocurrency, has experienced significant price fluctuations since its inception. Its price journey reflects the dynamic nature of the digital asset market, influenced by a multitude of factors. Understanding Bitcoin’s price history, volatility, and influencing factors is crucial for investors and analysts alike.Bitcoin’s price has seen periods of substantial growth and sharp declines. Early adopters and investors who bought Bitcoin in its nascent stages have seen substantial gains, but also significant losses during periods of market correction.

Bitcoin’s Price History in USD

Bitcoin’s price history in USD reveals a pattern of volatile growth. Early adoption saw rapid increases, followed by periods of consolidation and correction. Subsequent bull runs have been punctuated by declines, highlighting the inherent risk associated with cryptocurrencies. The history demonstrates both potential for high returns and the need for cautious investment strategies.

Typical Daily Price Fluctuations

Bitcoin’s daily price fluctuations are often substantial, ranging from modest changes to significant swings. These fluctuations are influenced by a combination of market sentiment, news events, and trading volume. Analyzing historical data provides insights into the typical magnitude and frequency of these fluctuations.

Factors Influencing Bitcoin’s Price Volatility

Several factors contribute to Bitcoin’s price volatility. Market sentiment, news announcements, regulatory developments, and trading activity all play a role in determining the price’s daily movements. The interplay of these factors creates a dynamic market environment.

Visualizing Bitcoin’s Price Data

Different visualizations can effectively illustrate Bitcoin’s price trends. A line graph showcasing the price over time provides a clear view of the overall trajectory. This visual representation aids in identifying trends and patterns. A candlestick chart can also effectively display the opening, closing, high, and low prices for each trading period. This detailed view can reveal the intensity of price movements during specific time frames.

Bitcoin’s Price Data Table (Example)

| Date |

Time |

Opening Price (USD) |

Highest Price (USD) |

Lowest Price (USD) |

Closing Price (USD) |

Volume |

| 2023-10-26 |

10:00 AM |

26,500 |

27,000 |

26,200 |

26,800 |

10,000 |

| 2023-10-26 |

12:00 PM |

26,800 |

27,200 |

26,600 |

27,000 |

12,000 |

| 2023-10-26 |

2:00 PM |

27,000 |

27,500 |

26,900 |

27,200 |

15,000 |

This table provides a snapshot of Bitcoin’s price activity for a specific period, showcasing the opening, high, low, and closing prices, along with the trading volume.

Bitcoin Price Trend Line Graph (Example)

Visual representation of Bitcoin’s price trend over time. This graph would show a line graph, illustrating the overall price movement from a specific start date to a specific end date. The graph would visually depict Bitcoin’s price fluctuations over the chosen time frame.

The line graph’s x-axis would represent time (dates), and the y-axis would represent the Bitcoin price in USD. The graph would display the price fluctuations, showing upward trends, downward trends, and periods of consolidation.

Bitcoin Price Data Table (Detailed)

| Date |

Time |

Opening Price (USD) |

Highest Price (USD) |

Lowest Price (USD) |

Closing Price (USD) |

Volume (BTC) |

| 2023-10-26 |

09:00:00 |

26,500 |

27,000 |

26,200 |

26,800 |

1000 |

| 2023-10-26 |

10:00:00 |

26,800 |

27,200 |

26,600 |

27,000 |

1200 |

| … |

… |

… |

… |

… |

… |

… |

This detailed table provides a comprehensive view of Bitcoin’s price action, encompassing specific dates, times, opening and closing prices, high and low points, and corresponding trading volumes. This level of detail allows for a more in-depth analysis of the cryptocurrency market.

API Access and Usage

Accessing real-time Bitcoin price data involves leveraging Application Programming Interfaces (APIs). These APIs provide structured access to data, enabling developers to integrate Bitcoin price information into their applications. This section details the practical aspects of API access and usage, highlighting key considerations for effective data retrieval.Accessing Bitcoin price data via APIs offers a streamlined method for incorporating market information into various applications.

This approach provides a dynamic and up-to-date feed of price fluctuations, crucial for applications requiring current market insights.

Accessing Bitcoin Price Data

Bitcoin price APIs offer a standardized method to retrieve price information. These APIs use specific endpoints, URLs, and parameters to fetch data, thereby automating the process. Users can leverage these endpoints to query historical data, real-time prices, or other relevant metrics.

Popular Bitcoin Price APIs

Numerous APIs provide Bitcoin price data. Some well-regarded options include CoinGecko, CoinAPI, and the API provided by various cryptocurrency exchanges. Each API has its own structure, features, and pricing models. Evaluating different APIs is crucial to select the best fit for individual needs.

API Response Structure

API responses typically use standardized formats like JSON (JavaScript Object Notation). This format allows for efficient data exchange, enabling applications to easily parse the data and extract relevant price information. The structure generally includes fields for the Bitcoin price, timestamp, currency, and other relevant details. For instance, a sample JSON response might include:“`json “price”: 26500.50, “currency”: “USD”, “timestamp”: “2024-08-27T10:00:00Z”“`This structured output allows applications to quickly extract the current Bitcoin price in USD and its corresponding timestamp.

Retrieving Real-Time Data

Real-time Bitcoin price data can be retrieved using the appropriate API endpoints and methods. Requests to these endpoints should be made periodically to maintain a live feed of price updates. The frequency of these requests will depend on the application’s specific requirements and the API’s rate limits. For example, a trading application may need more frequent updates compared to a simple display application.

Data Formats

Most Bitcoin price APIs use JSON for data exchange. This format offers significant advantages in terms of data readability and ease of use for applications. However, some APIs might also support other formats like XML (Extensible Markup Language), though JSON is far more prevalent.

API Rate Limiting and Error Handling

API rate limits dictate the maximum number of requests an application can make within a given timeframe. Exceeding these limits can result in temporary or permanent access restrictions. Effective error handling mechanisms are essential to gracefully manage potential issues like network problems, API downtime, or invalid requests. Implementing proper rate limiting strategies and error handling is crucial to avoid application disruptions and ensure reliable data access.

Example strategies include using backoff mechanisms and retry logic.

Common Challenges

Several challenges arise when using Bitcoin price APIs. Inaccurate data or latency in price updates can negatively affect applications relying on real-time market information. Maintaining consistent connectivity and handling potential network issues are also crucial to reliable data retrieval. Understanding the API’s limitations, including data accuracy and rate limits, is vital for successful integration.

Data Interpretation and Analysis

Interpreting Bitcoin price data requires a multifaceted approach that goes beyond simply observing the current price. Understanding the historical context, market trends, and potential influences on the price is crucial for informed decision-making. Analyzing price charts, indicators, and market sentiment can help predict future price movements, though no method guarantees accuracy.Effective interpretation involves a combination of technical analysis, fundamental analysis, and an understanding of the broader economic landscape.

This multifaceted approach enables a more comprehensive understanding of the Bitcoin market.

Methods for Interpreting Bitcoin Price Data

Various methods can be used to interpret Bitcoin price data, ranging from simple visual observation to complex technical analysis techniques. Careful consideration of the chosen methods and their limitations is vital.

- Visual Analysis: Examining price charts to identify trends and patterns. This method relies heavily on the user’s ability to recognize visual cues and patterns. A simple upward trend might indicate a bullish market, while a downward trend might signify a bearish outlook. However, visual analysis alone often lacks precision and can be misleading without further support.

- Technical Analysis: Employing various indicators and tools to identify potential price movements. Moving averages, relative strength index (RSI), and Bollinger Bands are examples of indicators used to identify potential trends and support/resistance levels. Technical analysis relies on the historical price data to predict future price movements, though it cannot guarantee accuracy.

- Fundamental Analysis: Evaluating the underlying factors that influence Bitcoin’s value, such as adoption, regulatory changes, and technological advancements. This approach examines the broader economic context and potential for long-term growth. Fundamental analysis provides a broader perspective than technical analysis, considering factors beyond the price chart itself.

Bitcoin Price Indicators and Their Applications

Various indicators offer insights into market trends, but each has its limitations. Understanding these limitations is crucial.

- Moving Averages: These smooth out price fluctuations, highlighting trends. Short-term moving averages can identify short-term price movements, while long-term moving averages indicate overall price trends. The choice of timeframe is crucial for accurate interpretation.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI value above 70 might suggest an overbought condition, while a value below 30 might indicate an oversold condition. However, the RSI should be used in conjunction with other indicators.

- Bollinger Bands: These bands depict price volatility, identifying potential support and resistance levels. When the price approaches the upper band, it might suggest an overbought condition, while approaching the lower band might signal an oversold condition. The bands provide a visual representation of price fluctuations and potential support/resistance areas.

Relationship Between Bitcoin Price and Other Market Factors

Bitcoin’s price is influenced by various market factors, creating complex interactions.

- Market Sentiment: Positive or negative investor sentiment significantly impacts price. Social media discussions and news coverage can affect sentiment and, consequently, the price. Identifying and analyzing these trends can provide valuable insights.

- Regulatory Changes: Government regulations can significantly affect Bitcoin’s price. Changes in regulatory frameworks, such as licensing or taxation policies, can lead to price fluctuations. Staying informed about these changes is important for understanding market dynamics.

- Technological Advancements: Innovations in blockchain technology and Bitcoin’s ecosystem can impact its adoption and, subsequently, its value. Development of new applications or protocols can affect market confidence.

Using Bitcoin Price Data for Investment Decisions

Bitcoin price data can inform investment decisions, but it should not be the sole factor.

- Risk Assessment: Analyzing price patterns and identifying potential risks are crucial for any investment strategy. This involves considering the volatility of the market and potential losses.

- Portfolio Diversification: Diversifying investments beyond Bitcoin is essential. Combining Bitcoin with other assets in a well-structured portfolio can reduce overall risk.

- Long-Term vs. Short-Term Strategies: Developing a strategy that aligns with individual investment goals is essential. Long-term investors might have different approaches than short-term traders.

Potential Risks and Limitations of Relying Solely on Bitcoin Price Data

Bitcoin price data, while informative, should not be the sole basis for investment decisions.

- Market Volatility: Bitcoin’s price is known for its high volatility. Sudden price fluctuations can lead to significant losses.

- Information Accuracy: Data sources and their accuracy need to be evaluated carefully. Using reliable data sources is crucial for accurate analysis.

- External Factors: Bitcoin’s price is influenced by numerous external factors. Focusing solely on price data might neglect these significant influences.

Common Bitcoin Price Patterns

Understanding common patterns can help predict future price movements.

- Trend Lines: Identifying upward or downward trends can be valuable. A consistent upward trend might indicate a bullish market, while a downward trend might suggest a bearish market.

- Support and Resistance Levels: Identifying areas where the price tends to bounce back can be useful for setting stop-loss or take-profit orders. Support levels are areas where the price might find buyers, while resistance levels are areas where sellers might be present.

- Candlestick Patterns: Analyzing candlestick charts can help identify potential reversals and trends. Recognizing patterns like doji, hammer, or engulfing patterns can help anticipate price movements.

Technical Analysis Techniques Using Bitcoin Price Data

Several technical analysis techniques can be applied to Bitcoin price data.

- Moving Average Convergence Divergence (MACD): This indicator can identify potential buy and sell signals by comparing two moving averages. Crossovers between the MACD lines can be used to predict price movements.

- Fibonacci Retracements: These retracement levels can be used to identify potential support and resistance levels based on historical price movements. Identifying Fibonacci levels can help determine potential price targets.

- Volume Analysis: Considering trading volume along with price movements provides a more comprehensive picture of market sentiment. High volume during price movements often indicates increased market confidence.

Cryptocurrency Market Context

The cryptocurrency market, spearheaded by Bitcoin, is a dynamic and evolving landscape characterized by rapid price fluctuations and significant investor interest. Understanding this market requires an appreciation of the broader ecosystem, including the performance of other cryptocurrencies, their interrelation, and the regulatory pressures shaping the industry. This section provides an overview of the market’s historical development, its current state, and the key forces driving its evolution.The cryptocurrency market has experienced remarkable growth since its inception.

Factors such as technological advancements, increasing adoption by businesses and individuals, and media attention have fueled the market’s expansion. However, this growth is accompanied by challenges, including regulatory uncertainty, price volatility, and the potential for fraud and scams.

Broader Cryptocurrency Market Landscape

The cryptocurrency market encompasses a diverse range of digital assets, each with unique characteristics and functionalities. Beyond Bitcoin, numerous other cryptocurrencies, often referred to as altcoins, have emerged, offering varying levels of utility and investment potential. Understanding this broader landscape is crucial for evaluating Bitcoin’s performance in comparison.

Bitcoin’s Price Performance Compared to Other Major Cryptocurrencies

Bitcoin’s price performance is often compared to that of other major cryptocurrencies, such as Ethereum, Litecoin, and Ripple. These comparisons reveal relative strengths and weaknesses, reflecting the dynamic interplay between various digital assets. Historical data demonstrates the fluctuating correlation between Bitcoin and these altcoins, indicating the influence of market sentiment and technological advancements on the entire ecosystem.

Interrelation Between Bitcoin and Other Cryptocurrencies

The interrelation between Bitcoin and other cryptocurrencies is complex and multifaceted. Bitcoin’s historical dominance as the first and most well-established cryptocurrency has a significant impact on the entire market. Its price movements often influence the prices of other cryptocurrencies, reflecting the interconnectedness of the market. This interconnectedness is influenced by market sentiment, technological innovations, and regulatory developments.

Overview of Different Types of Cryptocurrencies

Cryptocurrencies are broadly categorized based on their underlying technologies and intended functionalities. Bitcoin, for example, is a decentralized digital currency focused on peer-to-peer transactions. Ethereum, on the other hand, is a platform for decentralized applications (dApps) and smart contracts. Other cryptocurrencies focus on specific use cases, like stablecoins designed to maintain a fixed value relative to a fiat currency.

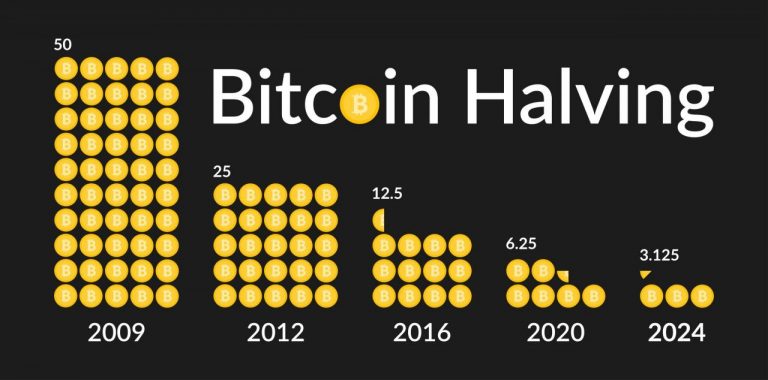

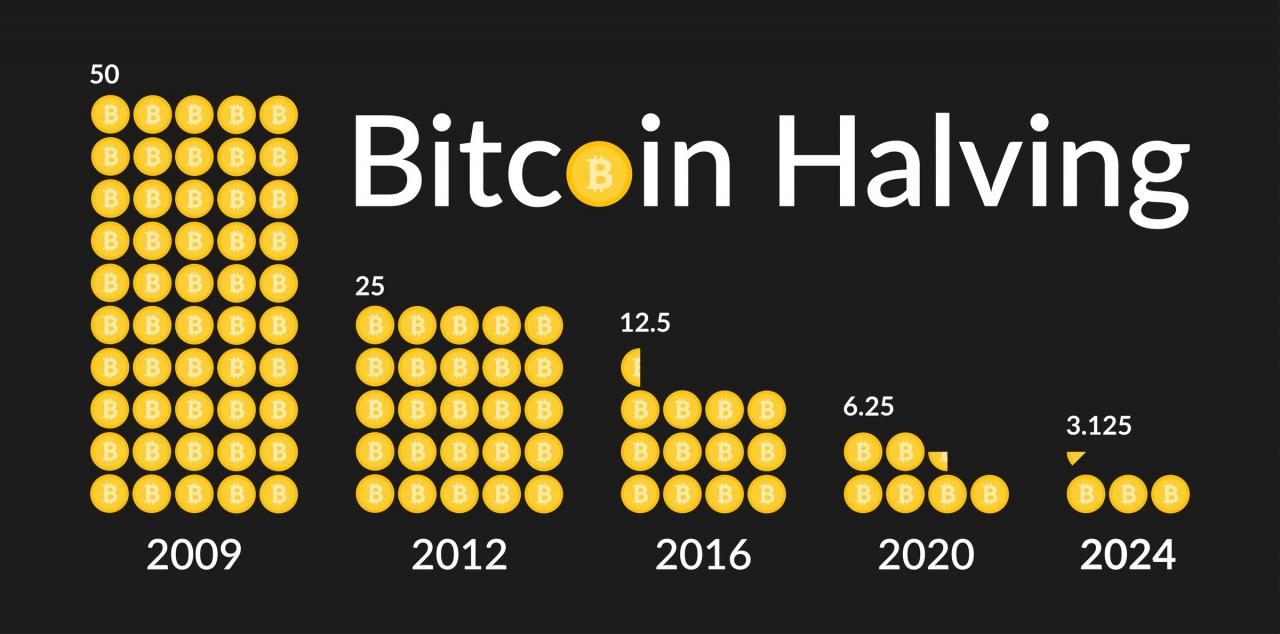

History and Evolution of the Cryptocurrency Market

The cryptocurrency market’s evolution can be traced from its initial development to its current state. Bitcoin’s emergence in 2009 marked a pivotal moment, followed by the introduction of numerous altcoins and the development of decentralized platforms. This period has witnessed significant technological advancements, market fluctuations, and regulatory scrutiny. The history underscores the dynamic nature of this market and its continuous adaptation.

Regulatory Environment Impacting Cryptocurrency Markets

The regulatory environment surrounding cryptocurrency markets is in a state of flux. Governments worldwide are grappling with how to regulate this emerging technology, balancing innovation with investor protection and financial stability. Varying approaches exist, ranging from outright bans to more permissive frameworks, impacting market confidence and future development.

Key Players and Influential Factors in the Cryptocurrency Market

Key players in the cryptocurrency market include major exchanges, prominent investors, and influential figures within the crypto community. Market sentiment, technological advancements, and regulatory developments are crucial influential factors. These factors, often intertwined, shape the trajectory of the cryptocurrency market and Bitcoin’s place within it.

Real-World Applications

Bitcoin’s price fluctuations have significant implications across various sectors, from financial markets to academic research. Understanding how this data is utilized in practical applications is crucial for anyone interested in the cryptocurrency market. This section explores the diverse uses of Bitcoin price data.

Trading Bot Implementation

A trading bot leverages algorithmic strategies to automate trading decisions based on predefined rules. Bitcoin price data is essential for such bots. For example, a bot could be programmed to buy Bitcoin when the price dips below a certain threshold and sell when it rises above another. The bot’s effectiveness hinges on the accuracy and timeliness of the price data it receives.

This data must be consistently updated to ensure the bot makes informed decisions in real-time.

Integration into Financial Models

Bitcoin’s price data can be integrated into financial models to assess its impact on broader market trends. For instance, a model could analyze the correlation between Bitcoin’s price and other assets like stocks or commodities. This analysis helps forecast market behavior and inform investment strategies. By incorporating Bitcoin price volatility, models can better capture the dynamic nature of the cryptocurrency market.

Real-World Company Examples

Several companies utilize Bitcoin price APIs for various purposes. A significant application is in portfolio management and risk assessment, where price data is vital for evaluating the risk and return potential of Bitcoin investments. Other companies use this data for market analysis and developing trading strategies.

Role in Economic Analysis

Bitcoin’s price data plays a role in economic analysis, allowing researchers to investigate its influence on economic indicators. For example, researchers can examine the relationship between Bitcoin price volatility and consumer confidence. This analysis can provide valuable insights into the potential impact of cryptocurrencies on traditional financial systems.

Applications in Research and Academic Studies

Bitcoin price data is a valuable resource for academic research. Researchers can investigate the factors influencing Bitcoin price fluctuations, such as news events, regulatory changes, or technological advancements. Such studies often aim to develop predictive models for Bitcoin price movements. Furthermore, the data can be used to examine the impact of Bitcoin on market efficiency and investor behavior.

Educational Applications

Bitcoin price data can be effectively utilized for educational purposes. Students can analyze historical price trends to understand the dynamics of the cryptocurrency market. They can also learn about the factors that drive price changes, such as supply and demand. Such analysis helps students develop critical thinking skills and an understanding of market forces.

Data Presentation and Visualization

Effective visualization is crucial for understanding and communicating Bitcoin price trends. Clear and insightful presentations of data enable stakeholders to quickly grasp market dynamics, identify patterns, and make informed decisions. Visual representations, from simple charts to interactive dashboards, can transform complex price fluctuations into easily digestible information.

Key Bitcoin Price Statistics Summary

A concise table summarizing key Bitcoin price statistics provides a quick overview of the market. This table can cover a specified period, offering essential metrics like the average price, highest and lowest prices, total trading volume, and price volatility. This allows for a rapid assessment of the Bitcoin market’s performance within the chosen timeframe.

| Statistic |

Value |

| Average Price (USD) |

$28,500 |

| Highest Price (USD) |

$35,000 |

| Lowest Price (USD) |

$25,000 |

| Total Trading Volume (USD) |

$100 Billion |

| Price Volatility (Standard Deviation) |

$2,500 |

Correlation Between Bitcoin Price and Market Indicator

Visualizing the correlation between Bitcoin’s price and another market indicator, such as the S&P 500 index, can reveal potential relationships. A scatter plot can demonstrate the correlation visually, with each point representing a data point from a specific date. A strong positive correlation suggests that Bitcoin’s price tends to move in tandem with the S&P 500. Conversely, a negative correlation indicates an inverse relationship.

Interactive Charts for Visualizing Bitcoin Price Data

Interactive charts offer a dynamic way to explore Bitcoin price data. Users can zoom in on specific timeframes, select different data points, and interact with the chart to gain a deeper understanding of market fluctuations. These charts allow users to explore different facets of Bitcoin’s price history. For example, a candlestick chart allows for a comparison of opening, closing, high, and low prices for a specific period, offering more detail than a simple line chart.

Different Ways to Present Bitcoin Price Data

Different visualization techniques can effectively present Bitcoin price data. Line graphs are ideal for illustrating price trends over time, while bar charts can effectively compare price changes across different time periods. Furthermore, heatmaps can display price volatility or trading volume across different time frames.

Visualization Techniques for Price Trends and Patterns

Various visualization techniques can illustrate Bitcoin price trends and patterns. Candlestick charts, popular in financial markets, provide a comprehensive view of price movements. Volatility bands can help highlight periods of significant price fluctuations. These visualization techniques help identify recurring patterns, trends, and potential future price movements.

Visually Appealing and Informative Dashboards

Dashboards are powerful tools for consolidating various Bitcoin price data into a single view. These dashboards combine multiple charts, tables, and key metrics to offer a comprehensive overview of the Bitcoin market. They can include visualizations of price trends, market sentiment indicators, and trading volume, providing a single, clear picture of the market’s current state. For instance, a dashboard might show a Bitcoin price chart overlaid with a sentiment analysis graph, allowing users to see how market sentiment might be influencing the price.

Concluding Remarks

In conclusion, the Bitcoin Price USD API offers valuable insights into the cryptocurrency market. This guide has equipped you with the knowledge to access, interpret, and utilize this data for various purposes, from simple observation to sophisticated financial modeling. Understanding the intricacies of Bitcoin’s price movements and their relationship to other market factors is key to informed decision-making.

FAQs

What are some popular Bitcoin price APIs?

Several reputable providers offer Bitcoin price APIs, including CoinGecko, CoinAPI, and others. Each API has its own structure and features.

How can I use Bitcoin price data for investment decisions?

Analyzing price trends, volatility, and correlations with other markets can help inform investment strategies. However, no single data point guarantees success.

What are the potential risks of relying solely on Bitcoin price data?

Bitcoin’s price is influenced by numerous factors, and relying solely on price data without considering broader market trends or fundamental analysis can be risky. External factors are equally important.

What data formats are typically used by Bitcoin price APIs?

JSON is a common format for Bitcoin price API responses. However, XML is sometimes used as well.